A Rust library for quantitative finance tools. Also the largest option pricing library in Rust.

🎯 I want to hit a stable v0.1.0 by the end of 2023, so any feedback, suggestions, or contributions are strongly welcomed!

Email me at: RustQuantContact@gmail.com

Join the Discord server: https://discord.gg/tQcM77h8vr

📰 Latest changes

See CHANGELOG.md for a full list of changes.

Features

🔗 Automatic Differentiation

Reverse (Adjoint) Mode Automatic Differentiation.

Currently only gradients can be computed. Suggestions on how to extend the functionality to Hessian matrices are definitely welcome.

Additionally, only functions

- Reverse (Adjoint) Mode

- Implementation via Operator and Function Overloading.

- Useful when number of outputs is smaller than number of inputs.

- i.e for functions

$f:\mathbb{R}^n \rightarrow \mathbb{R}^m$ , where$m \ll n$

- i.e for functions

- Forward (Tangent) Mode

- Implementation via Dual Numbers.

- Useful when number of outputs is larger than number of inputs.

- i.e. for functions

$f:\mathbb{R}^n \rightarrow \mathbb{R}^m$ , where$m \gg n$

- i.e. for functions

use RustQuant::autodiff::*;

fn main() {

// Create a new Graph to store the computations.

let g = Graph::new();

// Assign variables.

let x = g.var(69.);

let y = g.var(420.);

// Define a function.

let f = {

let a = x.powi(2);

let b = y.powi(2);

a + b + (x * y).exp()

};

// Accumulate the gradient.

let gradient = f.accumulate();

println!("Function = {}", f);

println!("Gradient = {:?}", gradient.wrt([x, y]));

}

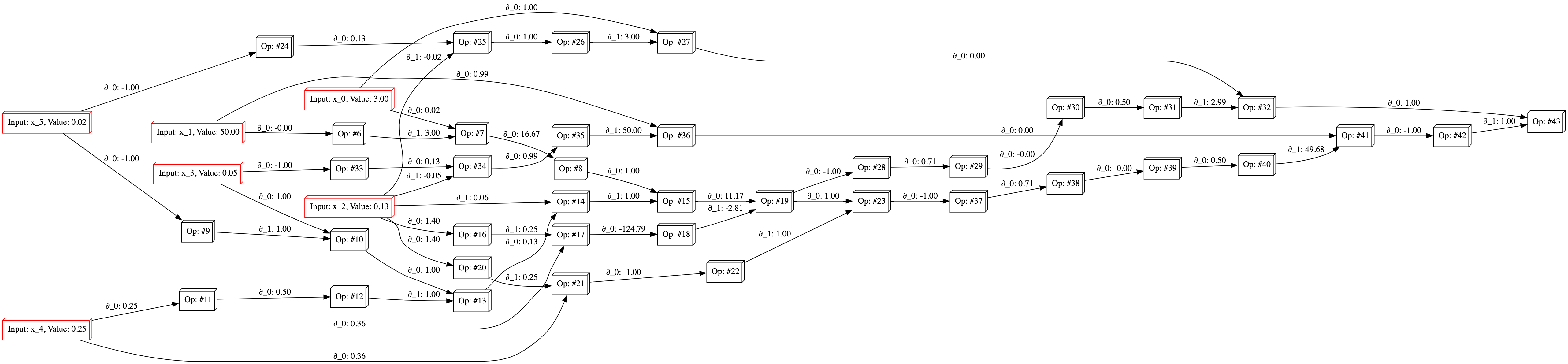

You can also generate Graphviz (dot) code to visualize the computation graphs:

println!("{}", graphviz(&graph, &variables));

The computation graph from computing Black-Scholes Greeks is:

It is clearly a work in progress, but gives a general idea of how the computation graph is structured.

If you want to improve the visualization, please feel free to submit a PR!

📊 Data

Methods for reading and writing data from/to various sources (CSV, JSON, Parquet). Can also download data from Yahoo! Finance.

You can:

- Download data from Yahoo! Finance into a Polars

DataFrame. - Compute returns on the

DataFrameyou just downloaded.

use RustQuant::data::*;

use time::macros::date;

fn main() {

// New YahooFinanceData instance.

// By default, date range is: 1970-01-01 to present.

let mut yfd = YahooFinanceData::new("AAPL".to_string());

// Can specify custom dates (optional).

yfd.set_start_date(time::macros::datetime!(2019 - 01 - 01 0:00 UTC));

yfd.set_end_date(time::macros::datetime!(2020 - 01 - 01 0:00 UTC));

// Download the historical data.

yfd.get_price_history();

// Compute the returns.

// Specify the type of returns to compute (Simple, Logarithmic, Absolute)

// You don't need to run .get_price_history() first, .compute_returns()

// will do it for you if necessary.

yfd.compute_returns(ReturnsType::Logarithmic);

println!("Apple's quotes: {:?}", yfd.price_history);

println!("Apple's returns: {:?}", yfd.returns);

}Apple's quotes: Some(shape: (252, 7)

┌────────────┬───────────┬───────────┬───────────┬───────────┬────────────┬───────────┐

│ date ┆ open ┆ high ┆ low ┆ close ┆ volume ┆ adjusted │

│ --- ┆ --- ┆ --- ┆ --- ┆ --- ┆ --- ┆ --- │

│ date ┆ f64 ┆ f64 ┆ f64 ┆ f64 ┆ f64 ┆ f64 │

╞════════════╪═══════════╪═══════════╪═══════════╪═══════════╪════════════╪═══════════╡

│ 2019-01-02 ┆ 38.7225 ┆ 39.712502 ┆ 38.557499 ┆ 39.48 ┆ 1.481588e8 ┆ 37.994499 │

│ 2019-01-03 ┆ 35.994999 ┆ 36.43 ┆ 35.5 ┆ 35.547501 ┆ 3.652488e8 ┆ 34.209969 │

│ 2019-01-04 ┆ 36.1325 ┆ 37.137501 ┆ 35.950001 ┆ 37.064999 ┆ 2.344284e8 ┆ 35.670372 │

│ 2019-01-07 ┆ 37.174999 ┆ 37.2075 ┆ 36.474998 ┆ 36.982498 ┆ 2.191112e8 ┆ 35.590965 │

│ … ┆ … ┆ … ┆ … ┆ … ┆ … ┆ … │

│ 2019-12-26 ┆ 71.205002 ┆ 72.495003 ┆ 71.175003 ┆ 72.477501 ┆ 9.31212e7 ┆ 70.798401 │

│ 2019-12-27 ┆ 72.779999 ┆ 73.4925 ┆ 72.029999 ┆ 72.449997 ┆ 1.46266e8 ┆ 70.771545 │

│ 2019-12-30 ┆ 72.364998 ┆ 73.172501 ┆ 71.305 ┆ 72.879997 ┆ 1.441144e8 ┆ 71.191582 │

│ 2019-12-31 ┆ 72.482498 ┆ 73.419998 ┆ 72.379997 ┆ 73.412498 ┆ 1.008056e8 ┆ 71.711739 │

└────────────┴───────────┴───────────┴───────────┴───────────┴────────────┴───────────┘)Apple's returns: Some(shape: (252, 7)

┌────────────┬────────────┬───────────────┬───────────────┬───────────────┬──────────────┬──────────────┐

│ date ┆ volume ┆ open_logarith ┆ high_logarith ┆ low_logarithm ┆ close_logari ┆ adjusted_log │

│ --- ┆ --- ┆ mic ┆ mic ┆ ic ┆ thmic ┆ arithmic │

│ date ┆ f64 ┆ --- ┆ --- ┆ --- ┆ --- ┆ --- │

│ ┆ ┆ f64 ┆ f64 ┆ f64 ┆ f64 ┆ f64 │

╞════════════╪════════════╪═══════════════╪═══════════════╪═══════════════╪══════════════╪══════════════╡

│ 2019-01-02 ┆ 1.481588e8 ┆ null ┆ null ┆ null ┆ null ┆ null │

│ 2019-01-03 ┆ 3.652488e8 ┆ -0.073041 ┆ -0.086273 ┆ -0.082618 ┆ -0.104924 ┆ -0.104925 │

│ 2019-01-04 ┆ 2.344284e8 ┆ 0.003813 ┆ 0.019235 ┆ 0.012596 ┆ 0.041803 ┆ 0.041803 │

│ 2019-01-07 ┆ 2.191112e8 ┆ 0.028444 ┆ 0.001883 ┆ 0.014498 ┆ -0.002228 ┆ -0.002229 │

│ … ┆ … ┆ … ┆ … ┆ … ┆ … ┆ … │

│ 2019-12-26 ┆ 9.31212e7 ┆ 0.000457 ┆ 0.017709 ┆ 0.006272 ┆ 0.019646 ┆ 0.019646 │

│ 2019-12-27 ┆ 1.46266e8 ┆ 0.021878 ┆ 0.013666 ┆ 0.011941 ┆ -0.00038 ┆ -0.00038 │

│ 2019-12-30 ┆ 1.441144e8 ┆ -0.005718 ┆ -0.004364 ┆ -0.010116 ┆ 0.005918 ┆ 0.005918 │

│ 2019-12-31 ┆ 1.008056e8 ┆ 0.001622 ┆ 0.003377 ┆ 0.014964 ┆ 0.00728 ┆ 0.00728 │

└────────────┴────────────┴───────────────┴───────────────┴───────────────┴──────────────┴──────────────┘)Read/write data

use RustQuant::data::*;

fn main() {

// New `Data` instance.

let mut data = Data::new(

format: DataFormat::CSV, // Can also be JSON or PARQUET.

path: String::from("./file/path/read.csv")

)

// Read from the given file.

data.read().unwrap();

// New path to write the data to.

data.path = String::from("./file/path/write.csv")

data.write().unwrap();

println!("{:?}", data.data)

}

📊 Distributions

PDFs, CDFs, MGFs, CFs, and other ditrubution related functions for common distributions.

Probability density/mass functions, distribution functions, characteristic functions, etc.

- Gaussian

- Bernoulli

- Binomial

- Poisson

- Uniform (discrete & continuous)

- Chi-Squared

- Gamma

- Exponential

📈 Instruments

Various implementations for instruments like `Bonds` and `Options`, and the pricing of them. Others coming in the future (swaps, futures, CDSs, etc).

📉 Bonds

- Prices:

- The Vasicek Model

- The Cox, Ingersoll, and Ross Model

- The Hull–White (One-Factor) Model

- The Rendleman and Bartter Model

- The Ho–Lee Model

- The Black–Derman–Toy Model

- The Black–Karasinski Model

- Duration

- Convexity

💸 Option Pricing

-

Closed-form price solutions:

- Heston Model

- Barrier

- European

- Greeks/Sensitivities

- Lookback

- Asian: Continuous Geometric Average

- Forward Start

- Bachelier and Modified Bachelier

- Generalised Black-Scholes-Merton

- Basket

- Rainbow

- American

-

Lattice models:

- Binomial Tree (Cox-Ross-Rubinstein)

The stochastic process generators can be used to price path-dependent options via Monte-Carlo.

- Monte Carlo pricing:

- Lookback

- Asian

- Chooser

- Barrier

use RustQuant::options::*;

fn main() {

let VanillaOption = EuropeanOption {

initial_price: 100.0,

strike_price: 110.0,

risk_free_rate: 0.05,

volatility: 0.2,

dividend_rate: 0.02,

time_to_maturity: 0.5,

};

let prices = VanillaOption.price();

println!("Call price = {}", prices.0);

println!("Put price = {}", prices.1);

}

📐 Mathematics

Fast Fourier Transform (FFT), numerical integration (double-exponential quadrature), optimisation/root-finding (gradient descent, Newton-Raphson), and risk-reward metrics.

Optimization and Root Finding

- Gradient Descent

- Newton-Raphson

Note: the reason you need to specify the lifetimes and use the type Variable is because the gradient descent optimiser uses the RustQuant::autodiff module to compute the gradients. This is a slight inconvenience, but the speed-up is enormous when working with functions with many inputs (when compared with using finite-difference quotients).

use RustQuant::optimisation::GradientDescent;

// Define the objective function.

fn himmelblau<'v>(variables: &[Variable<'v>]) -> Variable<'v> {

let x = variables[0];

let y = variables[1];

((x.powf(2.0) + y - 11.0).powf(2.0) + (x + y.powf(2.0) - 7.0).powf(2.0))

}

fn main() {

// Create a new GradientDescent object with:

// - Step size: 0.005

// - Iterations: 10000

// - Tolerance: sqrt(machine epsilon)

let gd = GradientDescent::new(0.005, 10000, std::f64::EPSILON.sqrt() );

// Perform the optimisation with:

// - Initial guess (10.0, 10.0),

// - Verbose output.

let result = gd.optimize(&himmelblau, &vec![10.0, 10.0], true);

// Print the result.

println!("{:?}", result.minimizer);

}Integration

- Numerical Integration (needed for Heston model, for example):

- Tanh-Sinh (double exponential) quadrature

- Composite Midpoint Rule

- Composite Trapezoidal Rule

- Composite Simpson's 3/8 Rule

use RustQuant::math::*;

fn main() {

// Define a function to integrate: e^(sin(x))

fn f(x: f64) -> f64 {

(x.sin()).exp()

}

// Integrate from 0 to 5.

let integral = integrate(f, 0.0, 5.0);

// ~ 7.18911925

println!("Integral = {}", integral);

}Risk-Reward Metrics

- Risk-Reward Measures (Sharpe, Treynor, Sortino, etc)

🔮 Machine Learning

Currently only linear regression is implemented (and working on logistic regression). More to come in the future.

Regression

- Linear (using QR or SVD decomposition)

- Logistic (via IRLS, adding MLE in the future).

💰 Money

Implementations for `Cashflows`, `Currencies`, and `Quotes`, and similar objects.

CashflowCurrencyMoneyQuoteLeg

📈 Stochastic Processes and Short Rate Models

Can generate Brownian Motion (standard, arithmetic and geometric) and various short-rate models (CIR, OU, Vasicek, Hull-White, etc).

The following is a list of stochastic processes that can be generated.

- Brownian Motions:

- Standard Brownian Motion

$dX(t) = dW(t)$

- Arithmetic Brownian Motion

$dX(t) = \mu dt + \sigma dW(t)$

- Geometric Brownian Motion

$dX(t) = \mu X(t) dt + \sigma X(t) dW(t)$

- Fractional Brownian Motion

- Standard Brownian Motion

- Cox-Ingersoll-Ross (1985)

$dX(t) = \left[ \theta - \alpha X(t) \right] dt + \sigma \sqrt{r_t} dW(t)$

- Ornstein-Uhlenbeck process

$dX(t) = \theta \left[ \mu - X(t) \right] dt + \sigma dW(t)$

- Ho-Lee (1986)

$dX(t) = \theta(t) dt + \sigma dW(t)$

- Hull-White (1990)

$dX(t) = \left[ \theta(t) - \alpha X(t) \right]dt + \sigma dW(t)$

- Extended Vasicek (1990)

$dX(t) = \left[ \theta(t) - \alpha(t) X(t) \right] dt + \sigma dW(t)$

- Black-Derman-Toy (1990)

$d\ln[X(t)] = \left[ \theta(t) + \frac{\sigma'(t)}{\sigma(t)}\ln[X(t)] \right]dt + \sigma_t dW(t)$

use RustQuant::stochastics::*;

fn main() {

// Create new GBM with mu and sigma.

let gbm = GeometricBrownianMotion::new(0.05, 0.9);

// Generate path using Euler-Maruyama scheme.

// Parameters: x_0, t_0, t_n, n, sims, parallel.

let output = (&gbm).euler_maruyama(10.0, 0.0, 0.5, 10, 1, false);

println!("GBM = {:?}", output.paths);

}

📆 Time and Date

Time and date functionality. Mostly the `DayCounter` for pricing options and bonds.

DayCounter

🤝 Miscellaneous Functions and Macros

Various helper functions and macros.

A collection of utility functions and macros.

- Plot a vector.

- Write vector to file.

- Cumulative sum of vector.

- Linearly spaced sequence.

-

assert_approx_equal!

✔️ How-tos

Guides for using RustQuant.

See /examples for more details. Run them with:

cargo run --example automatic_differentiationI would not recommend using RustQuant within any other libraries for some time, as it will most likely go through many breaking changes as I learn more Rust and settle on a decent structure for the library.

🙏 I would greatly appreciate contributions so it can get to the v1.0.0 mark ASAP.

📖 References

References and resources used for this project.

- John C. Hull - Options, Futures, and Other Derivatives

- Damiano Brigo & Fabio Mercurio - Interest Rate Models - Theory and Practice (With Smile, Inflation and Credit)

- Paul Glasserman - Monte Carlo Methods in Financial Engineering

- Andreas Griewank & Andrea Walther - Evaluating Derivatives - Principles and Techniques of Algorithmic Differentiation

- Steven E. Shreve - Stochastic Calculus for Finance II: Continuous-Time Models

- Espen Gaarder Haug - Option Pricing Formulas

- Antoine Savine - Modern Computational Finance: AAD and Parallel Simulations

Disclaimer

This is currently a free-time project and not a professional financial software library. Nothing in this library should be taken as financial advice, and I do not recommend you to use it for trading or making financial decisions.