The code repository for SOFTS: Efficient Multivariate Time Series Forecasting with Series-Core Fusion in PyTorch. A scalable pure MLP model that achieves state-of-the-art performance on multivariate time series forecasting benchmarks.

scikit-learn==1.2.2

numpy==1.22.4

pandas==1.2.4

torch==1.10.0+cu111

You can directly download the datasets used in the paper from Google Drive or NJU Box.

Once downloaded, place the datasets under folder dataset/, like dataset/ETT-small, dataset/traffic, etc.

If you wish to utilize your own datasets, please follow these steps:

-

Dataset Format: Make sure your datasets follow the format of the provided datasets. Typically, the first column should contain dates, and the remaining columns should represent variables to predict. This consistency will help seamlessly integrate your datasets into the existing infrastructure.

-

Dataset Class Creation: Create a dataset class within

data_provider/data_loader.py. Refer to the structure of theDataset_Customclass for guidance. This class should handle the loading and preprocessing of your dataset. -

Update Data Dictionary: Update the

data_dictindata_provider/data_factory.pyto include your dataset. -

Usage in Scripts: Utilize your dataset within the scripts by specifying the appropriate parameters.

- The

--dataparameter should match the dataset key within thedata_dict. - The

--root_pathparameter should point to the folder containing your dataset. - The

--data_pathparameter should specify the file name of your dataset.

- The

Refer to the examples in scripts/long_term_forecast for guidance on how to integrate your custom dataset into the existing scripts.

We have provided a custom exp class in exp/exp_custom.py and a guidance Jupyter notebook run_on_your_own_dataset.ipynb to help you run the model on your own dataset.

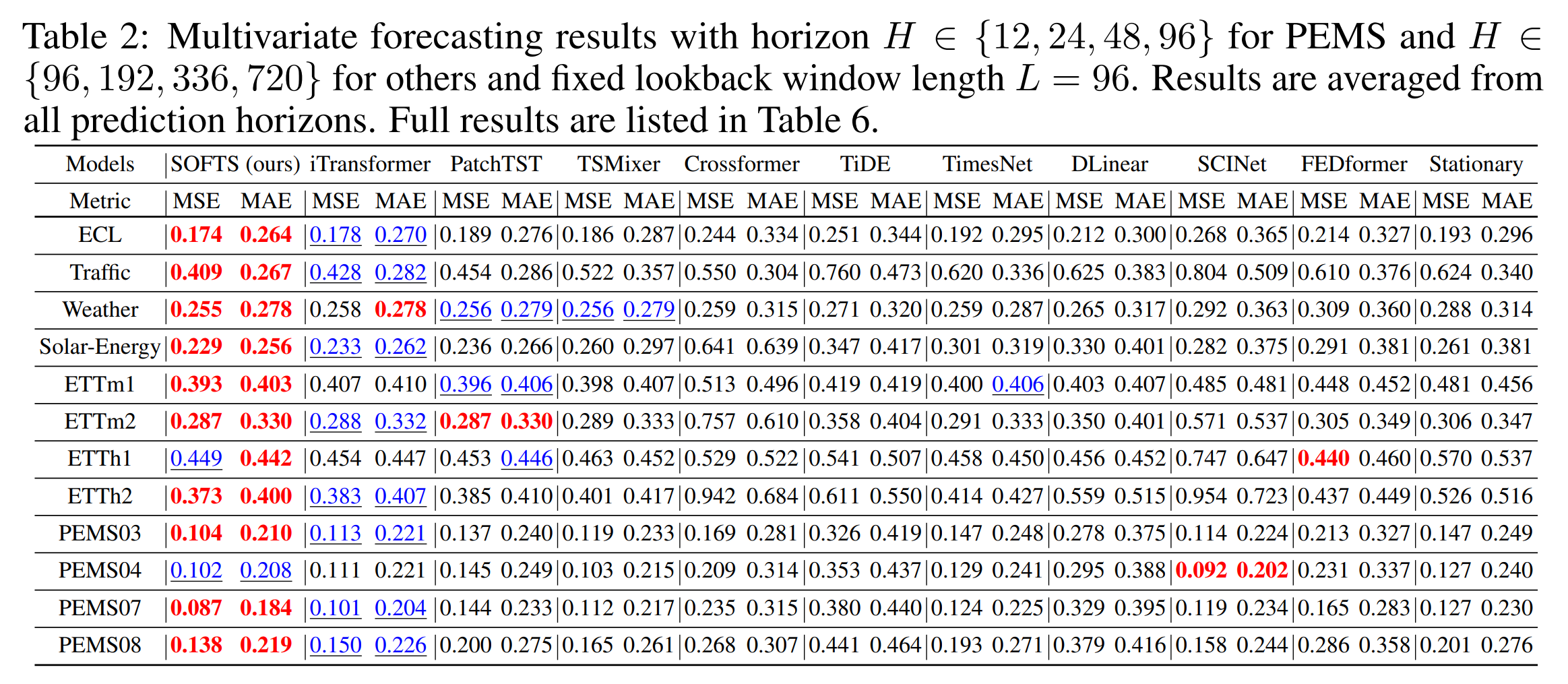

To reproduce the main results in Table 2, run the script files under folder scripts/long_term_forecast.

For example, to reproduce the results of SOFTS on ETTm1 dataset, run the following command:

sh scripts/long_term_forecast/ETT_script/SOFTS_ETTm1.sh

We appreciate the following github repos a lot for their valuable code base or datasets:

https://github.com/zhouhaoyi/Informer2020

https://github.com/thuml/Autoformer

https://github.com/zhouhaoyi/ETDataset

https://github.com/laiguokun/multivariate-time-series-data

https://github.com/thuml/Time-Series-Library

https://github.com/thuml/iTransformer

If you find our work useful in your research, please use the following citation:

@article{han2024softs,

title={SOFTS: Efficient Multivariate Time Series Forecasting with Series-Core Fusion},

author={Han, Lu and Chen, Xu-Yang and Ye, Han-Jia and Zhan, De-Chuan},

journal={arXiv preprint arXiv:2404.14197},

year={2024}

}