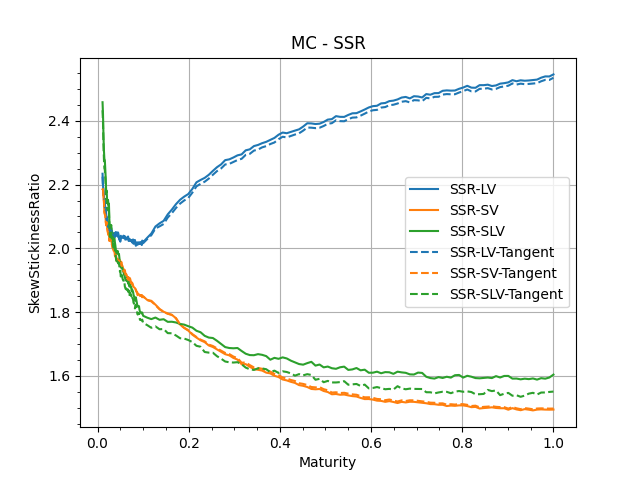

Computing Skew-Stickiness-Ratio for several models.

SSR is usually computed using bumped prices in Monte-Carlo.

We are describing a method involving Malliavin Calculus, using tangent processes, to replace the bumps usually used in Monte-Carlo methods.

This method is still a Monte-Carlo method.

One brownian process drives the evolution of the spot.

Usually fitted on market data, we are going to use a linear function, with time-dependent skew.

Similar to

with

Let's use two-factor Bergomi model. This uses 3 correlated brownian processes.

Parameters from

2 Factors

Volatility deformation

Instantaneous variance

Spot diffusion

Correlations - Brownian increments

Starting from a Local Volatility Model, and a Stochastic Volatility Model, we produce a Stochastic Local Volatility Model - using particle method calibration.

$$\mathcal{S}T = \frac{\mathrm{d} \hat{\sigma}{KT}}{\mathrm{d} \ln K}_{|F_T}$$

For every model, we price ATMF Option, imply

$$\mathcal{S}T = \nu \alpha\theta \left[ (1-\theta) \rho_{SX} \frac{k_X T - (1-\exp {-k_X T})}{(k_X T)^2} + \theta \rho_{SY} \frac{k_Y T - (1-\exp {-k_Y T})}{(k_Y T)^2} \right] $$

Model smile is fitted to local volatility.

$$\mathcal{R}_T = \frac{1}{\mathcal{S}T} \frac{\mathbb{E}\left[ \mathrm{d} \ln S \ \mathrm{d} \hat{\sigma}{F_T(S)\ T}\right]}{\mathbb{E}\left[ (\mathrm{d} \ln S)^2 \right]} $$

This will be eveluated numerically using MonteCarlo methods described in the next section.

$$\mathcal{R}T = \frac{ (1-\theta) \rho{SX} \frac{1 - \exp {-k_X T}}{k_X T} + \theta \rho_{SY} \frac{1 - \exp {-k_Y T}}{k_Y T} }{ (1-\theta) \rho_{SX} \frac{k_X T - (1 - \exp {-k_X T})}{(k_X T)^2} + \theta \rho_{SY} \frac{k_Y T - (1 - \exp {-k_Y T})}{(k_Y T)^2} } $$

Perturbation formula

Rather use

Reuse the derivatives for SSR.

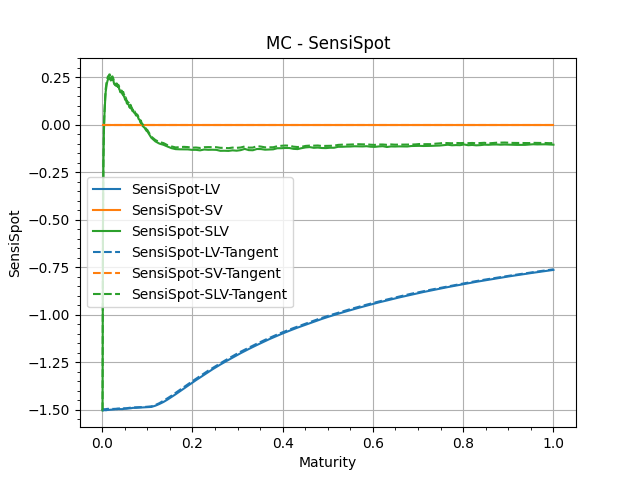

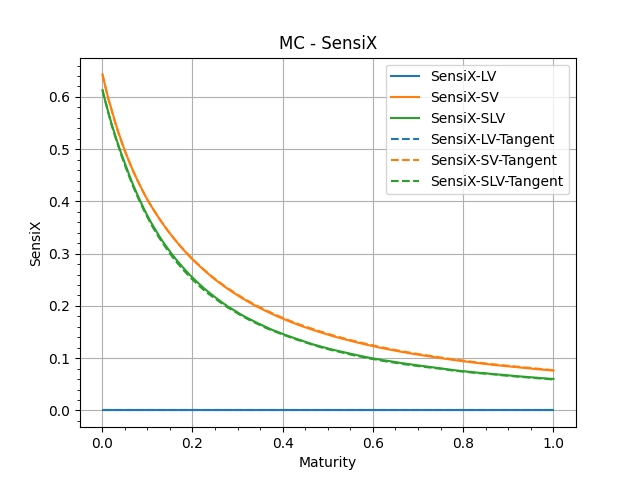

$$ \mathrm{d}\hat{\sigma}{F_T(S) \ T}= \frac{\mathrm{d}\hat{\sigma}{F_T(S) \ T}}{\mathrm{d} \ln S} \mathrm{d}\ln S + \frac{\mathrm{d}\hat{\sigma}{F_T(S) \ T}}{\mathrm{d} X} \mathrm{d}X + \frac{\mathrm{d}\hat{\sigma}{F_T(S) \ T}}{\mathrm{d} Y} \mathrm{d}Y $$

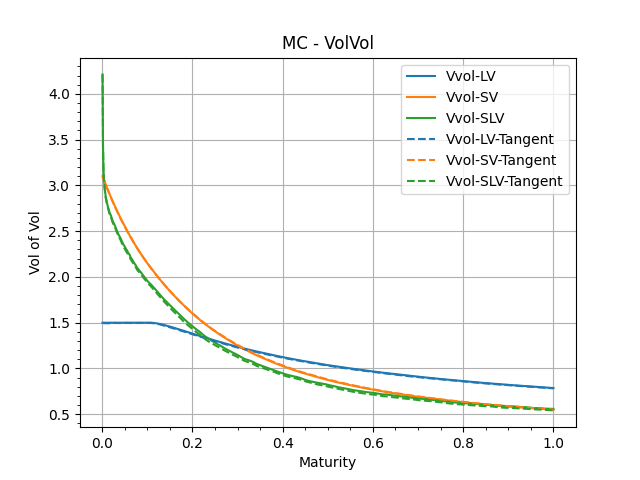

$$ vol\left(\hat{\sigma}{F_T(S)\ T}\right) = \sqrt{ \frac{\langle d \hat{\sigma}{F_T(S)\ T} , d \hat{\sigma}{F_T(S)\ T} \rangle}{\hat{\sigma}{F_T(S)\ T}^2 dt} } $$

$$\mathcal{R}T = \frac{1}{\mathcal{S}T} \frac{1}{\sigma_0} \left(\frac{ \hat{\sigma}{F_T(S)\ T}(\ln S_0 + \epsilon \sigma_0, X_0 + \epsilon \rho{SX}, Y_0 + \epsilon \rho_{SY}) - \hat{\sigma}_{F_T(S)\ T} (\ln S_0, X_0,Y_0) }{\epsilon}\right) $$

can be seen as 3 separate bumps.

Just one bump.

Model is homogenous, spot bumps has no effect.

We use the full formula.

no bump, but still MonteCarlo.

Malliavin Calculus requires uncorrelated Brownians.

However, we realized that we don't need to manipulate the uncorrelated brownian processes - the tangent processes simulations only use

$$ \mathbb{E}\left[ D_s^S \phi \right] = \mathbb{E}\left[ \mathbb{1}{{S_t > S_0}} \mathbb{1}{{s \in [0,t]}} \left(\frac{D_s^S S_t}{a_0 l(0,S_0)} - S_t \right) \right] $$

$$ \mathbb{E}\left[ D_s^X \phi \right] = \mathbb{E}\left[ \mathbb{1}{{S_t > S_0}} \mathbb{1}{{s \in [0,t]}} D_s^X S_t \right] $$

$$ \mathbb{E}\left[ D_s^Y \phi \right] = \mathbb{E}\left[ \mathbb{1}{{S_t > S_0}} \mathbb{1}{{s \in [0,t]}} D_s^Y S_t \right] $$

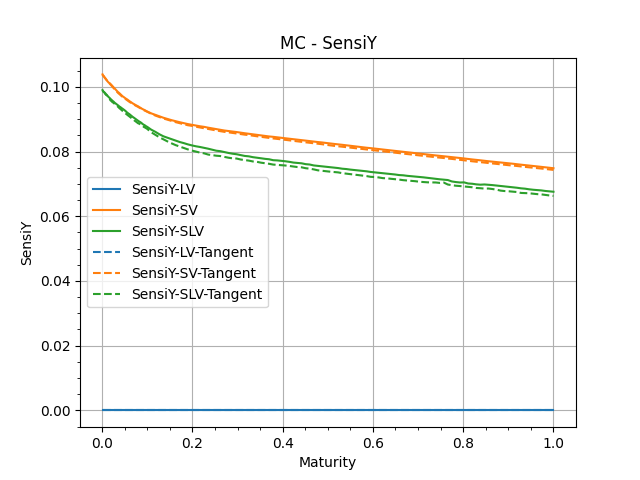

We use these sensitivities to evaluate the ATM Volatility of Volatility and the Skew-Stickiness-Ratio.

Running on my laptop (bought in 2019), with 16Go of RAM, Intel i708550U.

It takes about a minutes to run the script to build all the graphs below, with

Our implementation produces these quantities. Code is readable and runs fast.

Implementing the Tangent Processes is a bit of work, main benefit is to save a bumped price and have the sensitivity directly. The cost of implementing the Tangent Processes increases the number of state variables for the simulated paths, but does not require additional brownian simulation.

Another benefit of Tangent Process is that results are sometimes smoother, but this is not guaranteed - it does make sense intuitively, and is observed empirically.

These are the addiitonal quantities that are building blocks of the SSR and Vol of Vol.

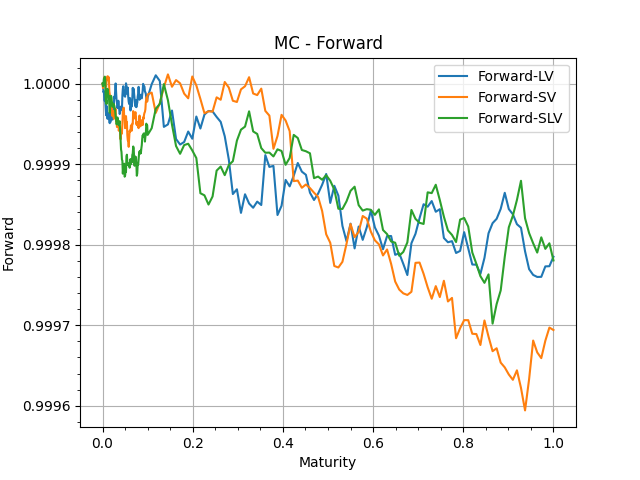

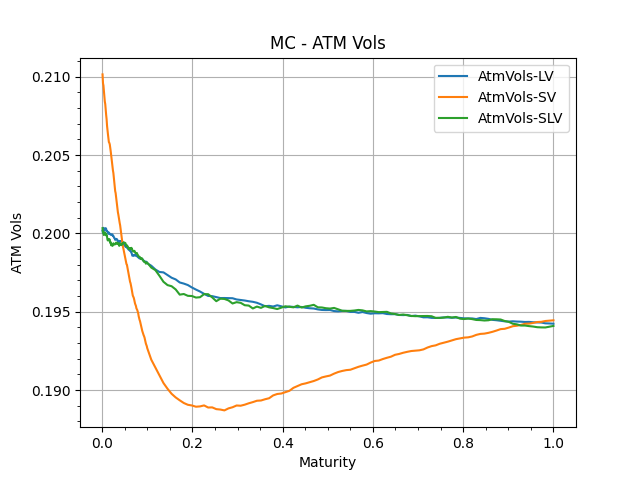

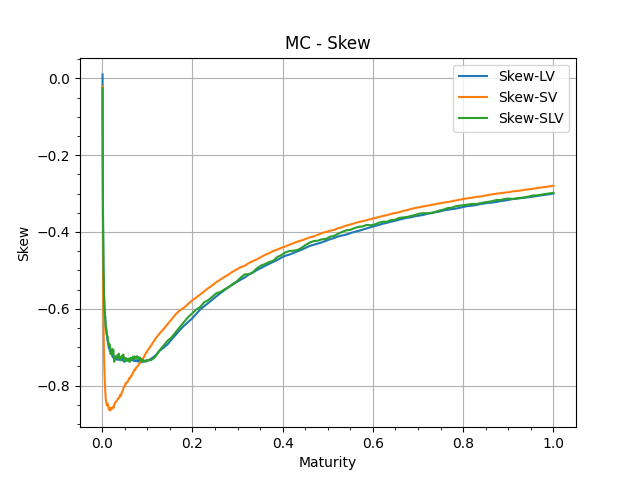

In each graph, we show 'Bump-Recompute' version and the 'TangentProcess' version.

These are sanity checks to confirm the numerical performances of our MonteCarlo simulations.

One important result we can observe is how close the SLV smile is to the LV smile, showing the success of the calibration method.

-

Lorenzo Bergomi, Stochastic Volatility Modeling, Chapman & Hall, ISBN 9781482244069

-

Pierre Henry-Labordère, Analysis, Geometry, and Modeling in Finance - Advanced Methods in Option Pricing, Chapman & Hall, ISBN 9781420086997, Chapter 11